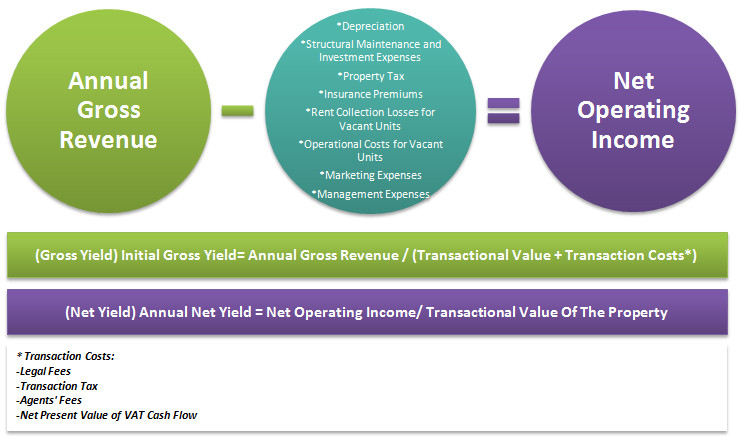

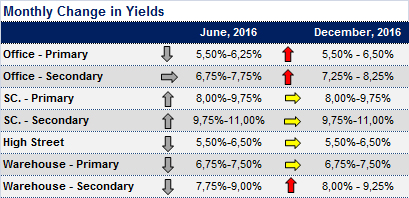

The yield stated on the table above, has been determined considering the annual gross revenue. Decrease in the net yield is observed; If we consider remaining 'Net Operating Income (NOI)', after the investors' share of operating expenses is subtracted from the gross revenue;

* The net yield remaines between 25-100 basis point (0,25% - 1%) lower for office, high street retail and warehouse functions.

* The investors' share of operating expenses in shopping centers is relatively higher. The net yield for shopping centers is 100-250 basis point (1% - 2,5%) lower compared to gross yield.